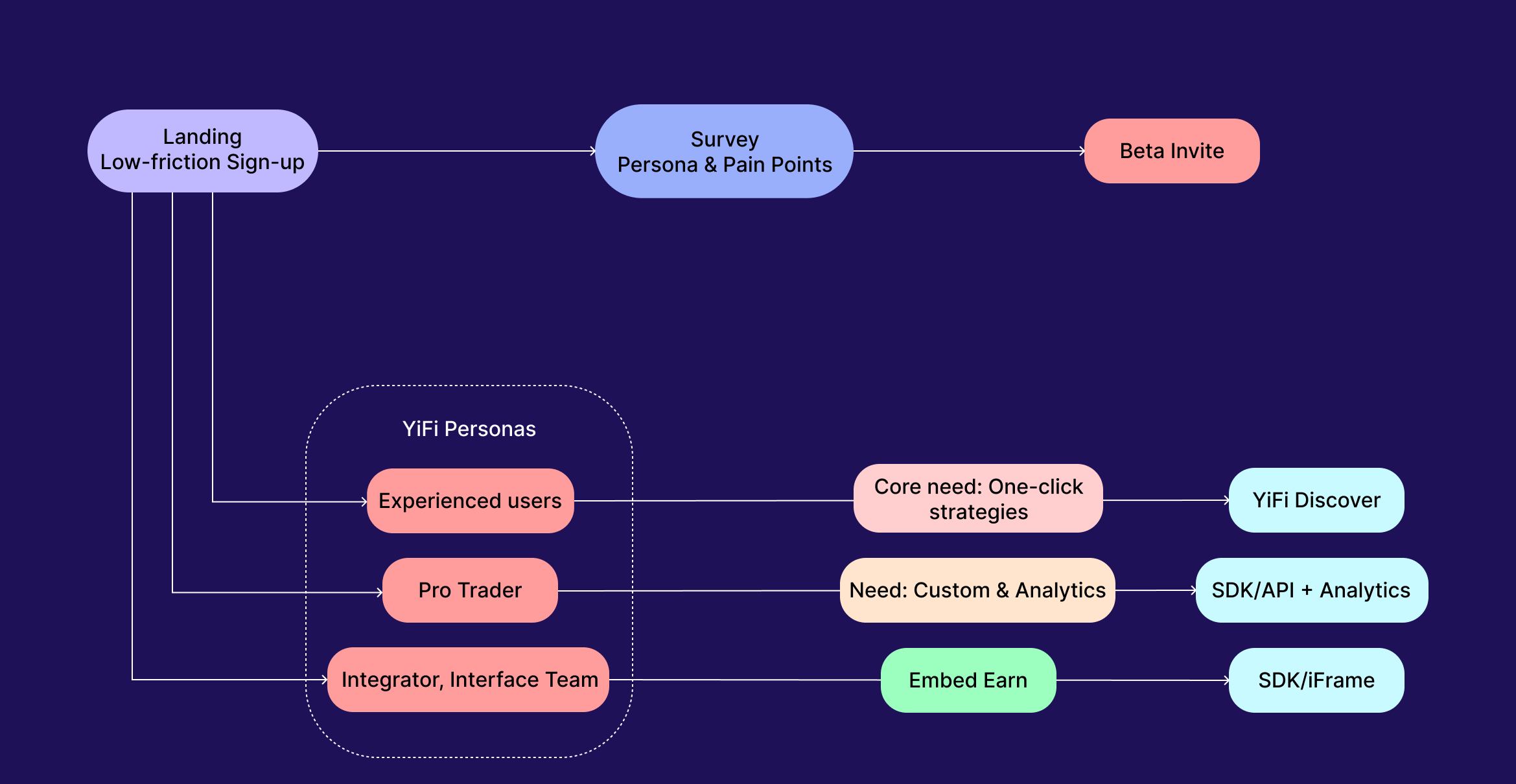

Use Cases

For DeFi Beginners

- Frictionless onboarding.

Simple wallet connection and a clear interface—no need to juggle multiple dApps. - Baseline strategies with clear risk.

Access conservative options (staking, fixed income, USD-denominated liquidity) with documented risk metrics and expected returns. - Personalized guidance.

Recommendations based on risk profile and goals; plain-English explanations of what’s happening under the hood. - Non-custodial by design.

User signs Zap transaction to enter the strategy in one-click. Zap operations are fully transparent and limited by user-approved slippage. YiFi acts as a router, not a custodian.

For Advanced Users

-

- Broader asset coverage.

Strategies with BTC, ETH, USD-denominated equivalents, LST/LRT, and yield-bearing tokens. - Diversification & composition.

Combine staking, lending, LPs, and structured products with one-click routing.

- Broader asset coverage.

- Market-neutral strategies.

YiFi delivers yield on blue-chip assets and stablecoins without impermanent loss or directional market exposure.

For Wallets and B2B Partners

- Strategy API & customizable embeds.

Access strategies via API, SDK, or embeddable widgets. Integrators can choose display formats, filter strategies by category, tokens, or chains, and build custom user flows on top of the YiFi execution layer. - Revenue sharing.

Built-in partner economics: platforms can earn through ref-share on user activity. Supports fixed percentages and full white-label setups. - Configurable strategy universe.

Integrators can tailor which strategies users see – by risk level, asset type, categories, or chains.